Are you wondering how to teach your kids the life skill of budgeting? Have you ever heard of the 50 / 30 / 20 Rule? Do you want to help your kids learn to become savvy money managers?

The concept of budgeting is essential to begin to teach early. Learning to manage money (or budget) is one thing that will have a long-lasting impact on your kid’s life.

There are tools to train your child on how to set up a kid’s budget. One concept to ingrain early is the 50 / 30 / 20 Rule.

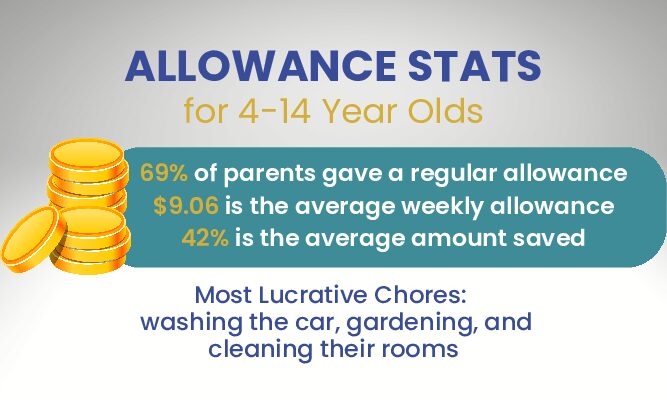

Source: PR Newswire

How to Set Up A Simple Budget For Allowance

Kids should have a pretty cushy life. They have the vast majority of their needs met by their parents. They have most of their wants met by Santa, the Easter Bunny, and the Birthday Fairy.

They don’t have a mortgage or car payments. Most adults would take that deal in a heartbeat.

But despite the generous benefactors, growing up is actually hard work. You have this short window of time to assimilate, accumulate and absorb all the habits, information, and education you will need to propel you into successful adulthood.

Parents are keenly aware of this fact, and that is why they spend an excruciating amount of time trying to pack lessons into all of the nooks and crannies of normal childhood activities.

Your 6-year-old wants to read a fun book? You make her sound out all the 2-5 letter words. Your 8-year-old wants to play a game? Time to bust out Monopoly so you can teach him about accumulating property. Your 10-year-old wants fries instead of broccoli with dinner? You make her put together a DIY food pyramid out of toilet paper rolls and pasta.

Then, when all of that education seems over the top because you don’t want to be one of those parents, you make sure to plan in lots of unscheduled time where they can do anything they want as long as it involves a specific list of Mensa-approved activities.

Childhood might slip like sand through a sieve, but its brief specter is hugely influential on the rest of our lives. So much of what makes us who we are comes from how we were raised.

Childhood Experiences that Stick With Us As Adults

It’s always fun to talk to friends and hear the stories of childhoods past that made them who they are today. “I grew up in an extremely disorganized house so I’m”…insert cleanliness habit here. “My parents never let me have sweets, so I”…insert eating habit here.

This phenomenon also holds true for financial habits. We know that there are habits of the financially successful, and childhood is an ideal time to instill them in our children.

One of the most popular and easy-to-follow kids’ budget habits is the 50/30/20 rule.

What is the 50/30/20 Rule?

The 50/30/20 rule is a budgeting tool that is simple and timeless. It has been used by financial planners for decades and is generally considered an excellent way to allocate your after-tax income.

- The first 50% of your after-tax earnings should go to Essentials. In financial literacy terms, these would be considered your needs: rent, groceries, utilities, gas, etc…

- The next 30% of your income is reserved for Fun. This is where you would find money to eat out at a restaurant, attend concerts or take vacations.

- The last 20% goes to the Future. This can be paying down debt or investing in retirement funds.

That’s the 50/30/20 rule for budgeting … but we think there is something missing.

Generosity: The 50/30/20 Oversight

The 50/30/20 rule is an excellent way to get people to start the budgeting process in an accessible way. They are nice round numbers. There are only three pots of money. It rolls off the tongue easily.

However, it’s missing one major component of financial and psychological health: Giving.

Generosity is a habit that’s especially important for kids, who are selfish by nature. “Sharing is caring” is a refrain often heard in the hallowed halls of many a preschool, and it’s for good reason.

According to Market Business News, generous people are generally happier people. But instead of being naturally generous and giving regularly, little kids tend to naturally use their limited control in life to guard what is theirs.

You can’t really blame them. Parents are always stealing their fries and older siblings like to adopt a “what’s yours is mine and what’s mine is mine” mentality.

Maybe it’s for this reason that kids love the expression “it’s not faaaaiiiiirrrrrr.” The truth is, they’re right. Life isn’t fair. But contrary to their perception, life usually isn’t fair in their favor.

Teaching kids to give is a good reminder to them that they are the fortunate ones, even when it might not feel like that’s the case because their brother got a hot dog for lunch and they were stuck with a PB&J.

Allotting some of their hard-earned money for people, especially helpless children, and animals, who are less fortunate than they are will serve the double goal of making them realize just how lucky they are, and how good it feels to give.

So, we’re going to add a giving component into the 50/30/20 rule in the kids budget by tweaking it just a little so that it still gets the point across, but also helps plant the seeds of generosity in their little hearts.

Needs and Giving: the 50 of the 50/30/20 Rule in a Kids Budget

The tricky thing about teaching kids the 50/30/20 rule is that most kids lack the first and biggest category: needs. Kids have needs, but most have all of their needs met by their parents.

Most financial literacy curriculums (including the one we teach on the My First Nest Egg app) start with needs v. wants. If you think children are born with a basic understanding of needs v. wants, you would be sorely mistaken. “I neeeeeeeeeeed” the random useless item that the grocery store has deemed essential to place right at 5-year-old kid level in the check-out line, said every kid ever.

Little people have very skewed ideas of needs v. wants. Yet, this is a vital lesson in life because we need to learn to fulfill our needs ahead of our wants. The 50/30/20 rule is actually an ideal lesson to teach kids because it incorporates the curriculum they’re learning on the My First Nest Egg app, and hammers home the most basic concepts of financial literacy.

Learn how to use the My First Nest Egg app by reading our Parents’ Guide.

Start by having a discussion with your child about their needs. If they’re doing their daily app quiz, this should be an easy one for them. Next, discuss how their basic needs are being met by you, their benevolent parent (hopefully this prompts some spontaneous feelings of gratitude).

Now you can move on to discussing how they can set aside 50% of their own income to help fulfill needs, but with a fun little twist. In the My First Nest Egg app, 50% of their allowance would be set aside for their “needs” in their spend account. A great start in kids’ budget.

This is where we will add the lesson on generosity.

They can use 40% on their own needs, but with items, they might deem a little more fun than the ones you might buy. Kids have all their needs met, but that doesn’t stop them from wanting the latest shoe style, cutest stuffy for bed, branded water bottle, or colorful backpack for school.

This is a golden opportunity to teach them about needs and engage them in buying more fun versions of childhood essentials. The other 10% they can use to help meet the needs of others less fortunate than themselves.

Imagine the juxtaposition of them using their money to buy themselves the latest fashionable pair of shoes, and setting aside a small portion to buy a foster child a very simple pair. This will show your child that life is indeed not fair, but that they can be part of the solution.

It will warm their little heart and they will associate those good feelings with acts of kindness. Your child will also have sacrificed something they earned for the good of another being, and the more that happens the better the world becomes for all of us.

If you want to know more about teaching kids to be savvy shoppers, read “Teach Kids to Resist Ads and Be Smart Consumers.”

Fun: the 30 of the 50/30/20 Rule

Most of the kids’ pocket money actually goes to “fun” so this should be the simple one for your child to grasp. The easiest way to save for “fun” is to go into your child’s savings account and create a savings goal either titled generically (“fun”) or more specifically something they are saving towards (a new lego set).

When your child is paid their allowance they can transfer 30% into this goal account. It will teach them goal setting and give them important feelings of pride and accomplishment when they reach their goal in their kid’s budget.

Future: the 20 of the 50/30/20 Rule

Teaching your kids to save 20% towards the future is the gift that will keep on giving throughout their lives. The earlier you start saving, the easier it is to grow a nest egg and retire comfortably. Most people miss crucial savings decades because it’s hard to think about retirement when you’re living your best life in your 20s.

When people settle down and realize they won’t be young forever, years are lost to poor financial planning. Getting into the habit of saving 20% of income towards the future will help your child emerge from their 20s far ahead of the average non-saver.

At My First Nest Egg, it is easy for your child to automatically put 20% of their allowance into savings. Simply go into their savings egg and set a 20% automatic transfer. This money will transfer into their Rainy Day Fund.

Regularly setting aside a portion of our income into savings is a basic budgeting principle that most people don’t apply. CNBC reported that only 39% of Americans could pay for a $1000 emergency expense!

It is important to set this automatic transfer with your child so they can be part of a proactive savings habit. The next thing to discuss with your child is how their savings can grow with compound interest.

This is another important financial literacy topic we tackle with our in-app financial literacy curriculum, and your child has an opportunity to experience the wonders of compound interest in addition to learning about it in the abstract.

You can go into your child’s savings egg and pick a fair interest rate. All of the money in their savings egg will earn that interest rate, compounded monthly.

First, you initiate the habit, and next, you reward them for adopting it.

Perfection? The Spirit of the Law – Yes, It Counts

Most adults do not properly apply the 50/30/20 rule, so it’s unrealistic to expect children to be perfect first-time adopters. It’s unnecessary, counterproductive, and, frankly, super depressing to expect perfection.

Simply introducing this topic to kids and giving them a fun, safe place to practice this type of easy budgeting is a win. The whole point of this exercise is to introduce some fairly lofty adult ideas into the practices of childhood.

It will be a win if 30 years down the road your child has grown into a responsible adult and is explaining to their friends that “I always set aside 20% for the future because as a child it ensured I always had something set aside for emergency candy store runs.”

New Budgeting Tools for Kids

Now that your child understands the 50/30/20 rule, let them have some fun with it. We have built the Good Egg Allowance Budgeting Calculator so kids can visualize what they should do with their allowance.

This will (hopefully) entice them to earn an allowance so they have money to budget. The calculator lets them put in their allowance (either weekly or monthly), play with the percentages, and see where they should put the money they earn.

They will be able to see that if they complete more puzzles and earn more allowance, they will be able to put more into the future and have a bigger budget for fun. If they are saving for a particular item, they can see how much faster they will earn it if they either allocate a higher percentage of money in its direction or increase their income.

Once your child has seen how they should split their after-puzzle income, next let them use our Savings Egg Compound Interest Calculator.

“The only thing that compounds

~ Orrin Woodward

faster than interest is learning.”

Calculating compound interest gives kids an excellent idea of how to make their money work for them. If they are using the My First Nest Egg app, they can be earning compound interest on their savings so it will be very real for them.

Playing with the Numbers

50/30/20 is an excellent starting point for everyone, including kids. But one of the fun things about calculators is that they let you experiment with what happens when you start playing with the numbers.

Most kids are going to realize pretty early on that they don’t have a lot of needs, – even accounting for the more fun versions of necessities.

So what if they only allocate 20% to their needs, 10% towards the local animal shelter, and 40% towards the future? And then take that money, add interest, and compound it over time? It’s like magic. And like magic you’ve reinforced the virtue of delayed gratification.

Conclusion

Starting conversations about budgeting a child’s allowance and other money topics is vital for families. As a country, we need to educate our way out of our current financial illiteracy epidemic.

Pennyhoarder.com surveyed more than 1500 people and concluded that 40% of people who didn’t talk about money growing up have nothing in savings.

Every tool that encourages these conversations is a win. You have a very short window to let your child practice adult ideas in the safety and security of their loving home, so it’s best to start early.