Frequently Asked Questions About My First Nest Egg

Who created this App?

The App was created by Nicolle and Annie, a couple of moms from Arizona who were frustrated by the lack of early childhood financial literacy solutions. We complained for a hot second and then did what moms do – started working on a solution. We worked with a developer on a no code platform called Bubble to iterate and make the App something that our mom friends love. That’s it. You can read more on the About Us page.

Is the App connected to any real money?

No, My First Nest Egg provides a virtual family bank. Our system tracks money parents are holding on behalf of their children. When you buy something for your child, simply deduct it from their virtual account. When you donate on behalf of your child, it’s easy to move the virtual money into their Give account. Because we are a virtual bank, you don’t have to enter any personal identifying information like your social security number or bank account number.

What is the Community Page?

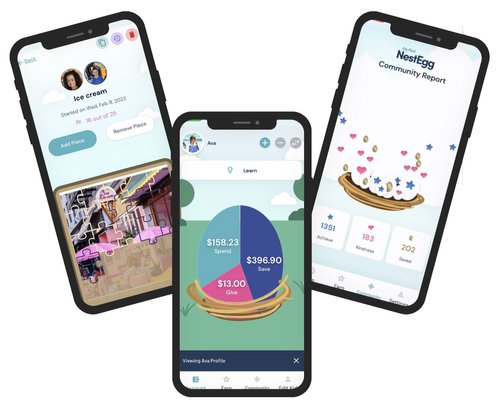

The Community Page is a place for kids to go to find community motivation. There are leaderboards for Achievements, Acts of Kindness, and Savings. The Savings leaderboard only tracks how many times money has been transferred into savings, not how much money has been transferred. The leaderboards reset every month at 12:01am on the first day of the month.

Why do you use puzzles to track earning?

We use puzzles to track earning for a few excellent reasons – all based in behavioral psychology. First, puzzles are fun! Kids need things to be fun if they’re going to keep engaging. Second, puzzles are the perfect way to teach kids the lifelong important skill of delayed gratification. Kids get instant gratification from earning a puzzle piece, and learn to delay their gratification of the overall “prize” until the end. Third, puzzles provide visual stimulus to keep kids motivated. There is nothing more frustrating than staring at an unfinished puzzle.

How much parental engagement does the App require?

Very little! The average interaction with the App is less than a minute. The real work is done outside the App. Kids achieve and engage in Acts of Kindness outside the App and then track those accomplishments in the App. Savings can be automatic (life skill!) and the Daily Fun Fact is just that – one fun fact a day to build financial knowledge.

What is “View Only Mode?

The View Only Mode allows a parent to have just one account for the whole family even if everyone is on a different device. In View Only your child can see their account and request puzzle pieces without being able to manipulate the money accounts or puzzles. From the View Only Mode kids can request puzzle pieces for achievements, and see their accounts and leaderboards. A four digit pin code is necessary to leave the View Only Mode.

How does the Give account work if the App uses virtual currency?

The Give account tracks three things: 1) Money your child has donated to charity. Parents keep track of this and donate to the charity and then move that money from the child’s Spend/Save account into the Give account. 2) Acts of Kindness. Generous kids are happier kids, but children don’t always have money to give, so we also track Acts of Kindness. 3) Community Service. Your child can keep track of hours and have a record of their service.

How much screen time does the App require from kids?

Very little! The average interaction with the App is less than a minute. The real work is done outside the App. Kids achieve and engage in acts of kindness outside the App and then track those accomplishments in the App. Savings can be automatic (life skill!) and the Daily Fun Fact is just that – one fun fact a day to build financial knowledge.

How does the App build self-worth in kids?

Everything we do in this App is meant to make kids feel proud of themselves. Kids feel proud when they achieve, accomplish and give. Achievement and depression are inversely related and it is our mission to put our finger on the scale for achievement so we can play a small part in helping parents raise mentally healthy kids.

How is My First Nest Egg different from other chore/financial literacy Apps?

My First Nest Egg is different from other products on the market because we were built for kids ages 3-12. Most of the other big name Apps are debit card based which can be appropriate for older kids. But little kids don’t need debit cards (we spent a decent amount of time imagining what little kids would do with debit cards:). Our entire system was designed to be fun for kids and help them build the habits they will need to successfully manage real funds and use a debit card one day. But if you have a little kid, that day is not today.

Will the App work if I don’t have cellular or wireless internet?

For now, no. Our App is a web App we developed using a no code platform called Bubble. Since it is a web App it only works when the user has access to the internet.

Can I give my kids interest on the money they put in Savings?

Yes! Click into the Save section of their Egg and it will give you the option to add interest. The interest is “paid-out” on the first of the month.

Can I set-up automatic savings transfers for my kids?

Yes! Click into the Save section of their Egg and it will give you the option to set-up automatic transfers. Once this is complete a percentage of whatever is added to their Spend account will automatically transfer to their Save account.

Why doesn’t the App have (insert whatever feature you would like here)?

My First Nest Egg was founded by two moms who launched in April, 2022. We want to hear from you about the features you love and the features you want, and then we will work to add needed features over time. We love and value your feedback.

I have ideas for how to improve My First Nest Egg. Do you want to hear them?

YES. Hearing from parents and users makes us so happy. Please use the Contact form to reach-out.