When I was growing up an “allowance” was a foreign concept – something my siblings and I assumed was only for rich kids.

For us, doing household chores was an expectation, not an optional side hustle. I wanted to earn money, so I learned to work outside of the home at a fairly young age – mowing neighbors’ lawns and babysitting by 10.

But we don’t live in the 80s anymore, and I didn’t grow up with an ounce of money management skills. Now our neighbors don’t want kids mowing their yards, and I don’t have time to drive my 10-year-old around to babysit. So, as much as everyone tends to idealize their childhood, it’s always important to take a step back and really analyze the right way to do things for your family, now.

Table of Contents

- What Is an Allowance?

- Cons of Giving Kids an Allowance: The Pitfalls of Allowance

- Pros of Giving Kids an Allowance

- 1. Financial Literacy and Independence

- 2. Work Ethic and Responsibility

- 3. Money Management and Budgeting Skills

- 4. Decision-Making and Consequence Awareness

- 5. Goal Setting and Delayed Gratification

- 6. Entrepreneurial and Money-Earning Opportunities

- 7. Financial Responsibility and Conscientiousness

- How Much Allowance is Appropriate

- How to Pay Allowance in a Cashless World

- In Conclusion: Allowance is a Yes

What Is an Allowance?

Giving a child an allowance means a regular payment, usually in exchange for housework, homework, or just generally picking their nose less. Paying kids’ allowance has been a topic of discussion among parents for decades. Some argue that children should not be paid for household responsibilities, while others recognize the benefits of providing them with a regular allowance.

There have been several surveys done to determine the average allowance of children and how much they are setting aside into savings. Interestingly enough, there is a significant disconnect between two prominent studies on this issue.

There was a 2019 survey widely quoted in the New York Times and NPR which put that number at $30/week, with only 3% of kids setting aside money in savings. It’s important to note that this survey included parents with children living at home aged 25 or younger. The average age in that study was 14, with many parents providing allowance to adult children.

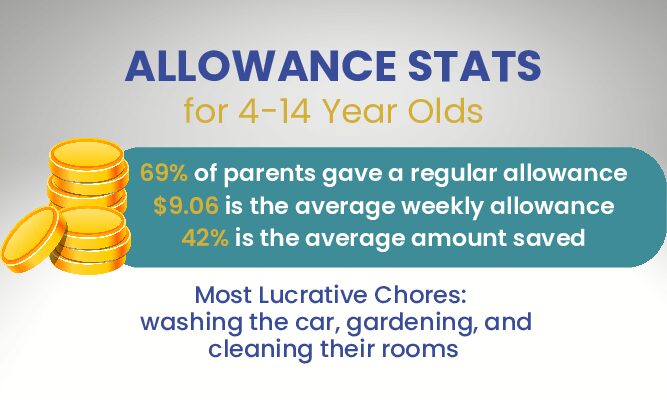

Since our primary interest is younger kids, we’ll put our focus there. In another survey that same year, the average among children ages 4-14 was $9/week (this seems much more reasonable), and those kids saved 42% of it (this is much more encouraging).

Source: PR Newswire

Allowances have become a popular method of teaching financial responsibility, with a significant 69% of parents choosing to provide their children with a regular allowance. Most kids are doing chores to earn their weekly income. The longest study of humans found that there are two key components in childhood that are statistically correlated with successful adults – love and chores.

Incorporating chores into the allowance system enhances its effectiveness. Certain tasks have proven to be particularly lucrative for children, including washing the car, gardening, and cleaning their rooms. By linking these chores to their allowance, parents can help their children understand the connection between work, effort, and financial rewards. Additionally, encouraging goal-oriented behavior through saving for specific purchases or future needs can empower children to make thoughtful spending choices. Overall, allowances, when managed wisely, serve as a practical tool for shaping a child’s financial education and preparing them for a financially responsible future.

Source: Unsplash

Cons of Giving Kids an Allowance: The Pitfalls of Allowance

Before discussing the benefits of allowance, it’s helpful to address some common reasons parents don’t pay their kids allowance. After all, 31% of parents choose not to pay their kids.

Giving children allowances can be a double-edged sword, as it can lead to certain issues if not handled properly. Even the term itself – “allowance”- suggests some kind of right to the money.

1. Entitlement

One common issue is the development of entitlement. If children receive a fixed amount of money regularly without having to work for it or understand its value, they may start feeling entitled to it, expecting to be handed money without any effort on their part. This can create a sense of dependency and a lack of understanding about the importance of hard work and financial responsibility.

To avoid this, parents can implement an allowance system that fosters financial literacy and a strong work ethic. Instead of providing an unconditional allowance, parents can tie it to age-appropriate chores or tasks that align with the child’s capabilities. This approach helps children understand that money is earned through effort and responsibility. Moreover, it is essential to engage in open conversations about finances and budgeting, explaining how allowances fit into the family’s overall financial planning. By involving children in discussions about saving, budgeting, and spending wisely, they can develop a better appreciation for money and its purpose.

2. Wasteful Spending

Another pitfall to watch out for is the lack of financial goal setting. Without clear objectives for their allowance, children may end up spending money impulsively on short-term gratification rather than learning to save for meaningful purchases or future needs. To address this, parents can encourage goal-setting and savings habits. For instance, children can be encouraged to set aside a portion of their allowance for saving up for larger purchases or for building an emergency fund. By instilling a sense of purpose and delayed gratification, parents can help their children develop a more responsible and mindful approach to money.

Want help motivating your kids to do their homework? Download the award-winning App that motivates kids to get good grades!

Pros of Giving Kids an Allowance

Source: Pexels

1. Financial Literacy and Independence

One of the primary reasons to pay kids an allowance is to foster financial literacy and independence. By receiving an allowance, children gain hands-on experience in managing money. They learn how to budget, save, and make choices about spending. This financial literacy empowers children to understand the value of money, distinguish between needs and wants, and become responsible consumers. As they navigate their financial decisions, they gain a sense of independence and confidence in managing their own finances.

Allowances also provide children with the opportunity to understand the basics of personal finance. They learn about income, expenses, and the importance of saving. Parents can use the allowance as a teaching tool, discussing topics such as budgeting, savings goals, and the value of money. These lessons enable children to develop essential skills that will serve them well throughout their lives.

Source: Unsplash

2. Work Ethic and Responsibility

Paying kids an allowance based on completing age-appropriate tasks instills a strong work ethic and sense of responsibility. When children understand that their allowance is tied to their effort and contribution, they develop a sense of accountability. They learn the importance of completing tasks and fulfilling responsibilities to earn their allowance. This work ethic translates into other areas of their lives, such as academics and future employment, where they understand the correlation between effort and reward.

Allowances can also teach children about the concept of earning money. By linking tasks and responsibilities to financial compensation, children learn that money is not freely given but earned through hard work. This understanding helps instill a strong work ethic and the value of perseverance. It teaches children that rewards are not handed out arbitrarily but come as a result of their efforts and dedication.

Source: Unsplash

3. Money Management and Budgeting Skills

Allowances provide children with a valuable opportunity to practice money management and budgeting skills. By receiving a fixed amount of money regularly, children learn to allocate funds for different purposes. They can divide their allowance into saving, spending, and perhaps even charitable giving. This early exposure to budgeting equips children with essential skills to plan and prioritize their expenses, avoid impulsive purchases, and develop a habit of saving for future goals.

In addition to budgeting, allowances help children understand the concept of scarcity and trade-offs. They realize that they have limited funds and must make choices about how to spend their money. This understanding fosters critical thinking skills as they evaluate different options, consider their priorities, and make decisions based on their financial goals. Children learn to assess the value of their purchases and weigh the short-term gratification against the long-term benefits of saving.

We developed a convenient budgeting calculator for kids where they can put in their allowance and figure out how much they should be saving, spending and giving according to sound financial principles. Learning to distribute income into each important bucket is an essential life skill. Adults who are financially secure know how to budget. It doesn’t matter how much money you make if you don’t know how to budget it for your wants, needs, and retirement.

Source: Pexels

4. Decision-Making and Consequence Awareness

Allowances offer children a controlled environment to make financial decisions and experience the consequences of their choices. When children have a set amount of money, they must consider their options, weigh the pros and cons, and make informed decisions. They learn to evaluate the value of different purchases, analyze the impact of their choices, and develop critical thinking skills. Through this process, they become aware of the consequences of impulsive or ill-informed financial decisions.

Parents can encourage their children to think critically by engaging them in discussions about their financial choices. By asking questions and guiding them through the decision-making process, parents help children understand the potential outcomes of their actions. If a child spends all their allowance on a single item, they may experience regret later when they realize they cannot afford something else they wanted. These experiences provide valuable lessons about the consequences of financial decisions and help children become more thoughtful and deliberate in their choices.

Source: Unsplash

5. Goal Setting and Delayed Gratification

Allowances encourage children to set financial goals and practice delayed gratification. By receiving a regular allowance, children can learn to save for something they desire. They develop the ability to set realistic goals, create a plan to achieve them, and patiently wait for the desired outcome. This skill of delayed gratification is essential for long-term success, as it teaches children the value of perseverance, discipline, and the ability to resist immediate gratification for greater rewards in the future.

Parents can guide their children in setting goals by discussing the importance of saving and the benefits of long-term planning. By helping children identify their wants and needs, parents can assist them in setting realistic and achievable goals. Whether it’s saving for a new toy, a special outing, or a more significant purchase, children learn the value of delayed gratification and the satisfaction that comes from achieving their goals through patience and perseverance.

Source: Unsplash

6. Entrepreneurial and Money-Earning Opportunities

Allowances can also inspire children’s entrepreneurial spirit and creativity. With their own money, children may seek additional opportunities to earn money, such as starting a small business, providing services to neighbors, or selling handmade crafts. These experiences not only teach children the value of hard work but also introduce them to the concepts of entrepreneurship, marketing, and financial planning. Such initiatives can foster innovation, creativity, and an entrepreneurial mindset from a young age.

Parents can encourage entrepreneurial endeavors by supporting and guiding their children in their money-earning ventures. By providing them with opportunities to explore their interests and talents, parents help children develop valuable skills such as problem-solving, communication, and financial management. These experiences can ignite a lifelong passion for entrepreneurship and set children on a path toward self-reliance and financial success.

Source: Pexels

7. Financial Responsibility and Conscientiousness

Allowances create an environment where children learn to be financially responsible and conscientious. As they receive a set amount of money, they are encouraged to make choices that align with their values and priorities. This fosters an understanding of the trade-offs involved in financial decisions, as well as the importance of distinguishing between needs and wants. Children can also learn about the value of charitable giving and the benefits of sharing their resources with others. By cultivating financial responsibility and conscientiousness, children develop a sense of empathy and a broader perspective on their role in society.

Parents can facilitate discussions about responsible spending and the impact of their financial choices on themselves and others. By encouraging children to consider the needs of others and the value of giving, parents nurture their sense of social responsibility and empathy. This mindset helps children develop a broader perspective on money and encourages them to use their resources wisely, not only for personal gain but also for the betterment of their communities.

Source: Unsplash

How Much Allowance is Appropriate

This question is extremely family and location specific. Paying children allowance first and foremost must fit into your family’s budget. One way to make that happen is to do a quick audit of some of the extras you buy your children – things to satisfy their wants, and not their needs. Then pay them an allowance which will allow them to buy those wants themselves. This won’t break your family budget, and it will give your child the ability to make wise choices with their money.

Allowance is also extremely age specific. Older kids will need more discretionary income than little kids. One of the difficult things about childhood is the lack of choice. Many kids are told where to go, how to dress, and what to do every day. Even a small allowance gives them choice and autonomy with how to spend the money. This can be as simple as a child with $2 in a grocery store picking out their favorite trinket or candy. If you’ve ever given your child money to spend, you know how their little brains grapple with the choices. It might just seem cute, but the truth is that they have now learned several important financial lessons, including budgeting, opportunity cost, and how much things cost.

Source: Pexels

How to Pay Allowance in a Cashless World

One issue we hear from parents is that it’s hard to pay their kid’s allowance because they rarely carry cash. This results in a difficult IOU system, or complicated spreadsheets which don’t work if not meticulously maintained. We developed the My First Nest Egg App to make it easier for parents to manage and learn about money. The App lets parents keep track of their kids’ allowance, pay a weekly allowance, and deduct virtual currency when they buy things kids ask for.

Source: Unsplash

In Conclusion: Allowance is a Yes

Paying kids an allowance is not just about providing them with money; it is about teaching them essential life skills and preparing them for future financial independence. By allowing children to manage their own money, they develop financial literacy, responsibility, and budgeting skills. They learn the value of hard work, decision-making, and delayed gratification. They also gain entrepreneurial insights and a sense of autonomy in managing their finances.

Ultimately, paying kids an allowance is an investment in their development, empowering them to become financially responsible adults who can navigate the complexities of the financial world with confidence. Through allowances, children gain invaluable skills that will serve them well throughout their lives, ensuring their financial well-being and success in an ever-evolving world.

Allowance without responsibility, however, can have a negative impact on children. It can make them believe that money is given, not earned. The goal with an allowance should be to mimic the real world in a fun, kid-friendly environment.

Whether you choose to give an allowance or not, remember that money habits are set by age 7. Childhood goes by quickly, and allowance can be an easy way to ensure that those habits are healthy ones, which will set kids up for a lifetime of financial success.